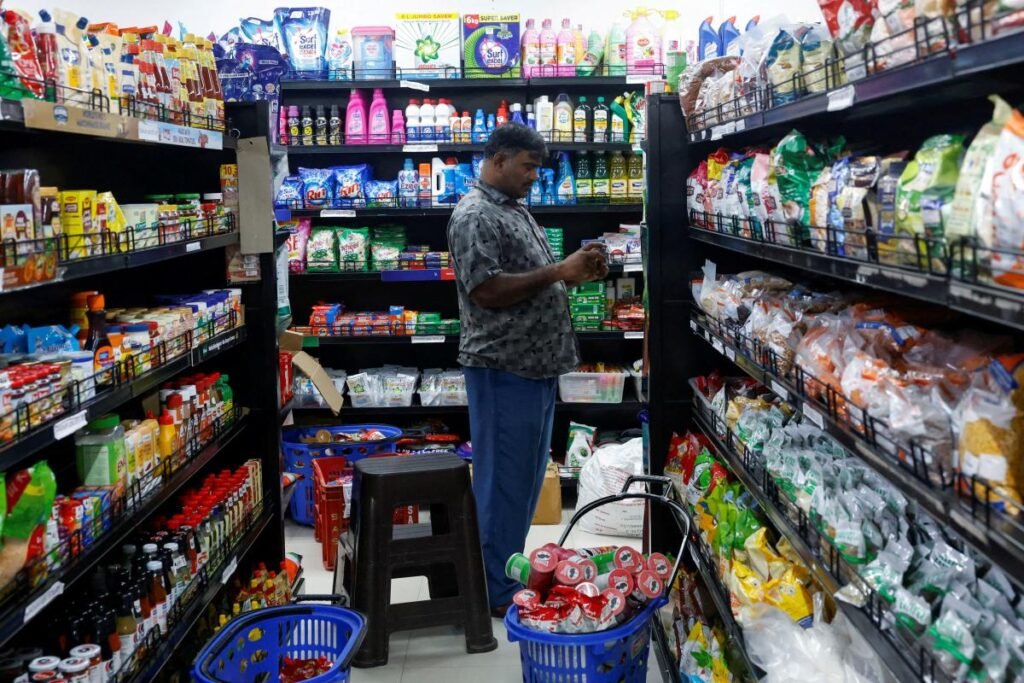

US inflation ticked up in September to 3% — a slightly lower than expected number that paves the way for the Federal Reserve to cut rates at its policy meeting next week.

In a report that got delayed more than a week because of the federal government shutdown, the Consumer Price Index jumped 3% in September over the past 12 months, according to the Bureau of Labor Statistics.

That was the fastest rate since the start of this year and a slight increase from the previous month’s 2.9% Still, economists polled by Bloomberg had expected a slightly hotter 3.1% year-over-year rate. The CPI rose 0.3% on a monthly basis.

Core inflation, which excludes volatile food and energy prices, also rose 3% over the past 12 months — though this was down slightly from 3.1% the previous month. It was expected to stay flat at 3.1%, according to economists polled by Bloomberg.

The Consumer Price Index should have been released on Oct. 15, but economic data has been halted by the government shutdown — now the second-longest in history at its 23rd day, with no end in sight.

“Inflation coming in weaker-than-expected further solidifies a continuation of the Federal Reserve’s rate cutting cycle, at least for the next two meetings,” Skyler Weinand, chief investment officer at Regan Capital, said in a note Friday.

“Once the government reopens and if we start to see weak unemployment data and the unemployment rate rises precipitously towards 5%, we could expect either a 50 basis point cut for December or the Fed to communicate a string of cuts in 2026.”

Wall Street has been desperate for any inklings into the state of the economy. The Dow Jones Industrial Average jumped 66 points, or 0.1%, premarket.

Questions have been raised, however, over the accuracy of the consumer inflation report, since so much of the government has been shut down.

The Federal Reserve is still widely anticipated to cut interest rates next Wednesday at the end of its policy meeting after issuing the first quarter-point cut last month since December 2024.

There has been dissent among Fed officials over how quickly they should ease policy. Fed Governor Stephen Miran, who was recently appointed by President Trump, has called for a half-point cut, while others like Christopher Waller have advocated for a quarter-point cut.

Economists are also keeping their eye on any sign that Trump’s tariffs have started to hit prices.

Read the full article here