Litecoin

The move, which made LTC as the largest weekly gainer among the top hundred tokens, comes as a mix of structural adoption and regulatory tailwinds.

In July, litecoin accounted for 14.5% of all crypto payments on CoinGate, the firm said in an X post, leapfrogging stablecoins like USDT and USDC and second only to bitcoin

.

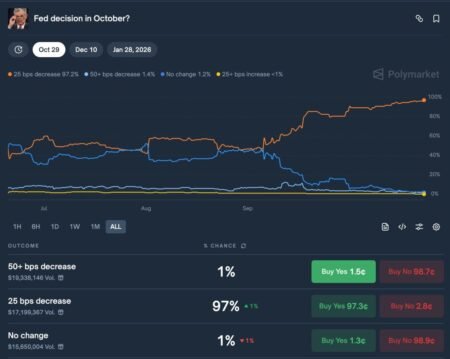

As such, speculation over a spot ETF continues to build despite the SEC delaying its decision on Grayscale’s application until October.

Bloomberg analysts pegged the odds of eventual approval at 90% in early July, citing LTC’s commodity classification by the CFTC — a distinction that reduces legal risk and places it alongside bitcoin and ether (ETH) in regulatory clarity.

Elsewhere, MEI Pharma disclosed a $100 million litecoin allocation last month, echoing early bitcoin treasury moves and giving LTC a new angle as a low-beta treasury asset. While the buy hasn’t moved markets materially, the optics help.

Meanwhile, data from CoinDesk Analytics shows LTC broke above its 7-day simple moving average and faces a key pivot level at $117.61. Relative strength index (RSI) sits at 69.5 — elevated, but not yet signaling exhaustion. However, early MACD divergence suggests momentum may be cooling if inflows don’t sustain.

Traders are watching $124–$131 as a resistance zone, per analytics, and a close above could signal a structural breakout.

Read the full article here