A new report by blockchain intelligence company TRM Labs showed that crypto-related crime had a record nominal value in 2025, albeit that the proportion of illicit activity in the wider digital asset economy kept dropping as a whole.

The report estimates that the volume of illegitimate cryptocurrencies had risen to $158 billion in 2025, 145% higher than the figure of a year ago, which was $64.5 billion.

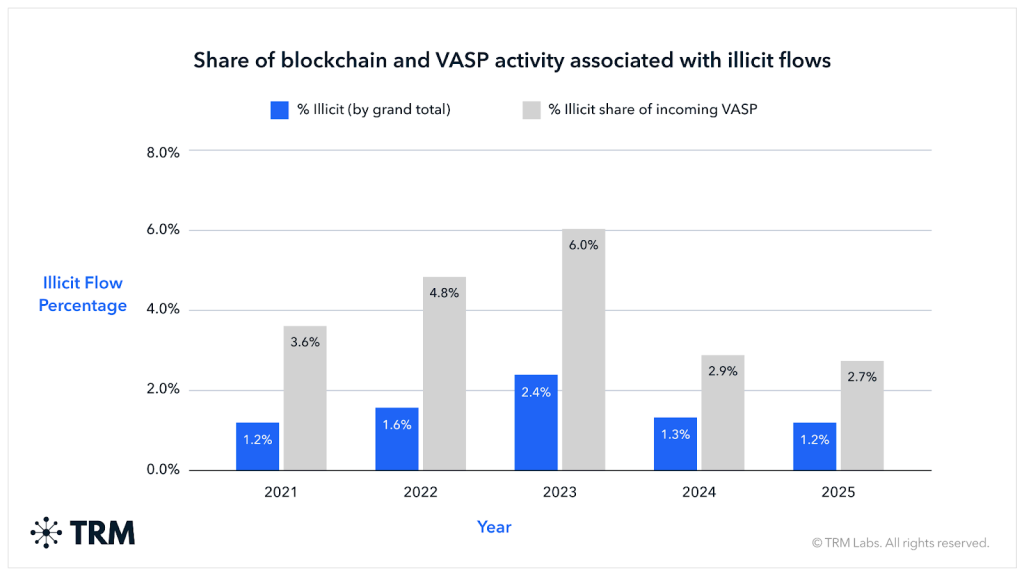

Although the dollar terms increased sharply, the illicit transactions formed only 1.2% of the entire on-chain volume, compared to 1.3% in 2024 and much less than the 2.4% high in 2023.

These numbers are generally in line with the estimates released this month by Chainalysis, which estimated crypto crime at $154 billion in 2025 as being less than 1% of total crypto activity.

Illicit Actors Capture Less Crypto Capital Despite Higher Volumes

To better capture risk, TRM introduced a new metric that measures illicit activity relative to deployable capital rather than raw transaction volume.

Through this method, the company discovered that the illicit players took 2.7% of the liquidity of the crypto in 2025 compared to 2.9% the year before and 6.0% the year before.

TRM said the data suggest that while certain illicit categories expanded in absolute terms, criminal actors absorbed a smaller proportion of new capital entering the ecosystem.

In 2025, activity related to sanctions had led to the illicit volume, mostly associated with Russia-related flows. TRM credited the growth to the increased use of A7A5, a ruble-pegged stablecoin that transacted a total volume of more than $72 billion throughout the year.

At least $39 billion of transactions were correlated to wallets belonging to the Russian sanctions-evasion system A7, suggesting a high level of coordination of an activity related to state-consistent financial infrastructure, instead of extensive use of the market.

Stablecoins were the main vehicle, and the activity moved to less regulated and riskier channels as enforcement increased.

Cryptography was reconfigured by geopolitical pressures that influenced several areas, as Venezuelans have turned into major users of stablecoins and peer-to-peer transactions to pay their daily income, remittances, and informal services due to the lack of economic stability.

In Iran, crypto buying and selling activities have been resilient to sanctions, with the total volume of transactions decreasing in the June 2025 Iran-Israel war, yet values went up, indicating larger transfers, with illegal operations reaching up to $580 million.

Scams, Hacks, and AI Fuel Crypto Crime in 2025

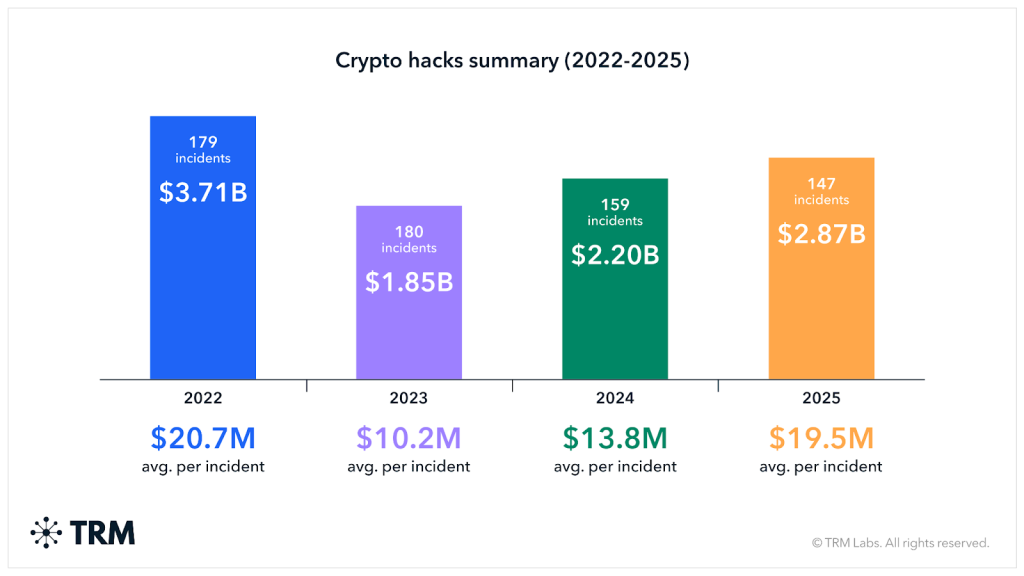

Another key cause of illicit volume was crypto theft, where $2.87 billion was stolen in almost 150 hacks and exploits in 2025.

Although there was a slight decrease in the number of incidents, the number of losses shot up as attackers began to target operational infrastructure instead of smart contracts.

In February, a single breach at Bybit, which was linked to the North Koreans, cost the company $1.46 billion, or over half of the entire annual losses.

In total, five cases accounted for about 70% of stolen money, underlining the impact of several big attacks on annual results.

Fraud remained persistent, with scams accounting for an estimated $35 billion in losses, similar to 2024 levels. Investment scams, including so-called pig butchering schemes and Ponzi operations, made up nearly two-thirds of that figure.

Stablecoins dominated fraud inflows, and TRM noted that criminal networks increasingly used generative AI to scale outreach and create more convincing deceptions while accelerating laundering to move funds within days of receipt.

Other illicit markets also expanded, with online drug trafficking reaching more than $3.4 billion in crypto volume, driven largely by Russian-language darknet marketplaces.

The post Crypto Crime Hits $158B in 2025 – But Illicit Use Keeps Falling, Says TRM appeared first on Cryptonews.

Read the full article here

Russia’s ruble-backed stablecoin A7A5 has surpassed more than $100 billion in transactions in less than a year.

Russia’s ruble-backed stablecoin A7A5 has surpassed more than $100 billion in transactions in less than a year. Iran is reportedly offering ballistic missiles, drones and warships to foreign governments for cryptocurrency, seeking payment routes that bypass Western financial controls.

Iran is reportedly offering ballistic missiles, drones and warships to foreign governments for cryptocurrency, seeking payment routes that bypass Western financial controls.