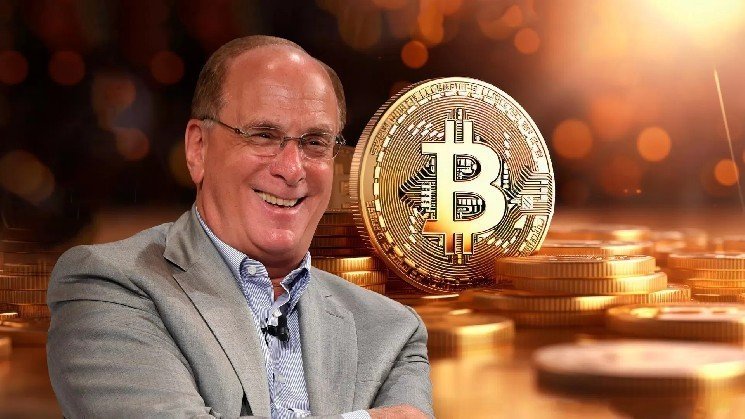

Larry Fink, CEO of BlackRock, the world’s largest asset management company, made a remarkable assessment of global monetary policies.

BlackRock CEO: “If Countries Continue to Devalue Their Currencies, Crypto Assets Will Be the Preferred Market”

“If people believe that countries will continue to devalue their currencies, they will choose crypto assets,” Fink said.

Fink’s statement came to the fore particularly in the context of recent rising inflation concerns and central banks’ policies to expand the money supply.

The famous CEO stated that Bitcoin and other digital assets stand out as an alternative store of value for investors in times when trust in the traditional financial system is weakened.

BlackRock has been showing increasing interest in the digital asset space in recent years. The company has over $10 trillion in assets under management, and the giant Fink-led fund entered the crypto market on an institutional scale with the launch of a spot Bitcoin ETF in 2024.

Fink’s statements were interpreted by the crypto community as “one of the most powerful figures in the financial world expressing confidence in digital assets.” Experts note that such rhetoric could further fuel institutional interest in major cryptocurrencies, particularly BTC and ETH.

This statement is considered an indication that crypto assets are moving towards “alternative reserve” status on a global scale.

*This is not investment advice.

Read the full article here